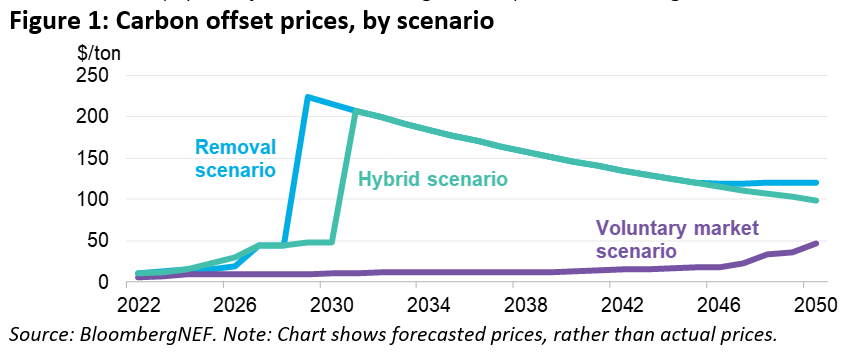

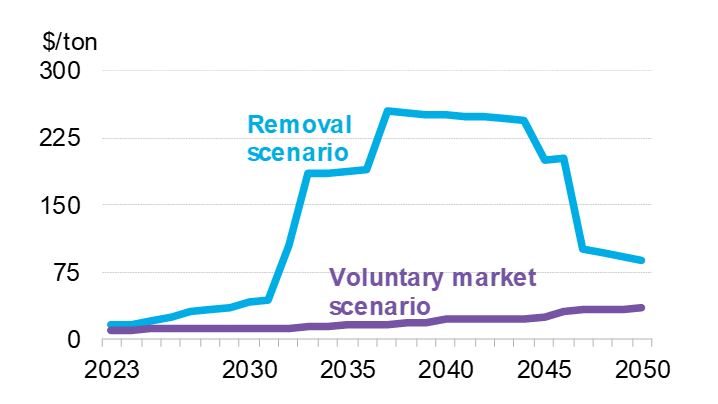

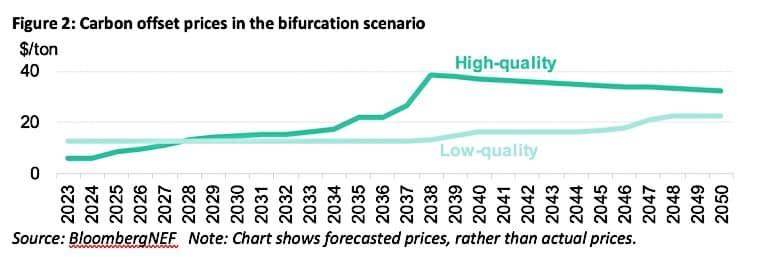

Carbon offsets price may rise 3,000% by 2029 under tighter rules | Insights | Bloomberg Professional Services

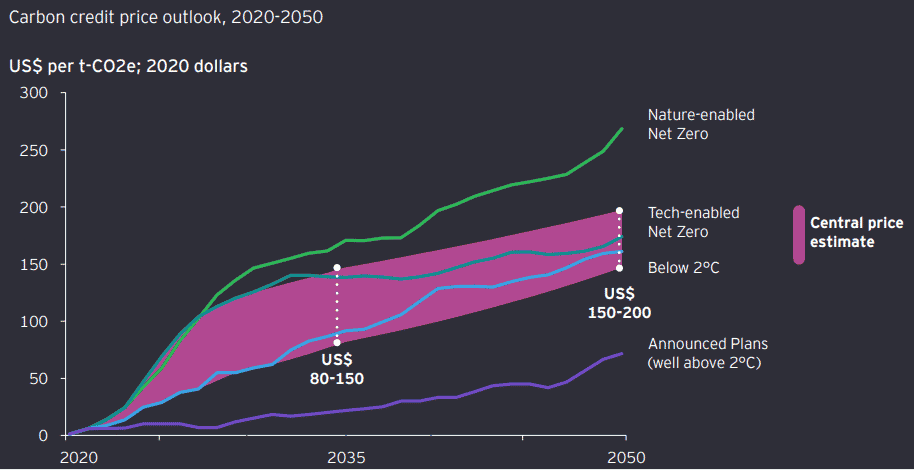

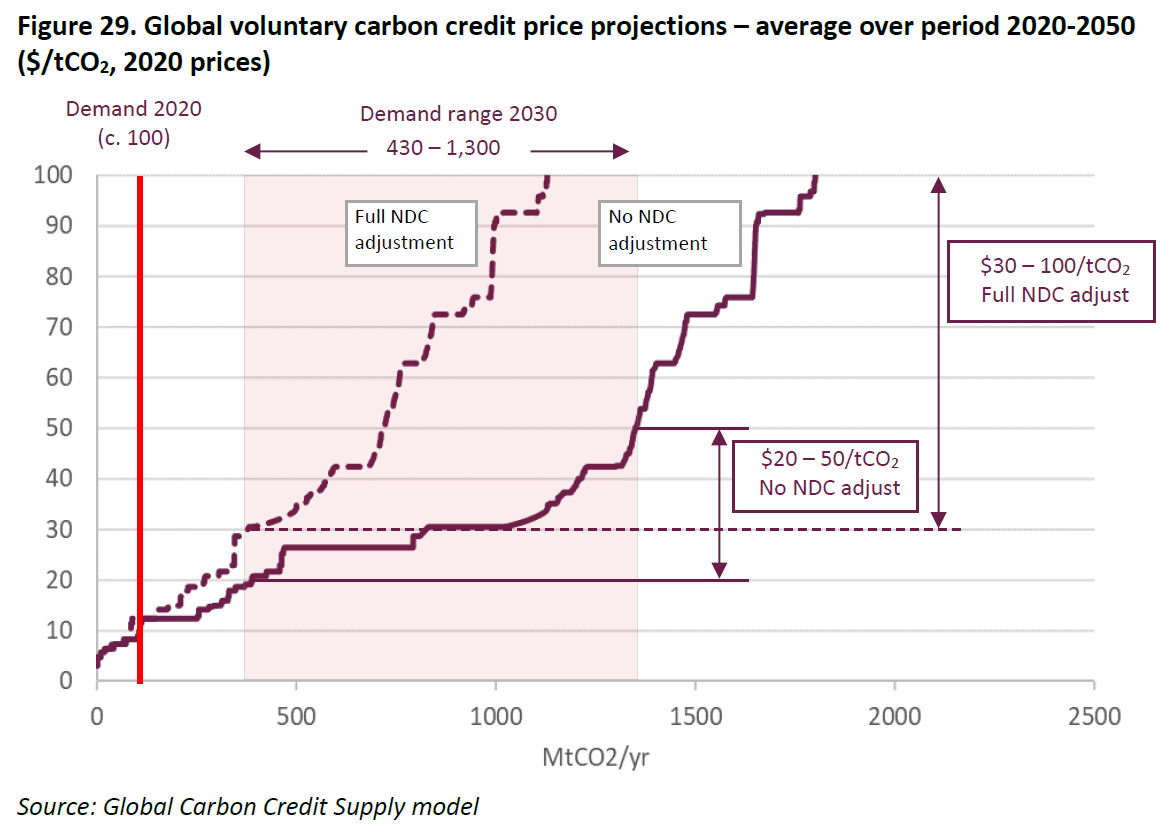

Voluntary carbon markets: how they work, how they're priced and who's involved | S&P Global Commodity Insights

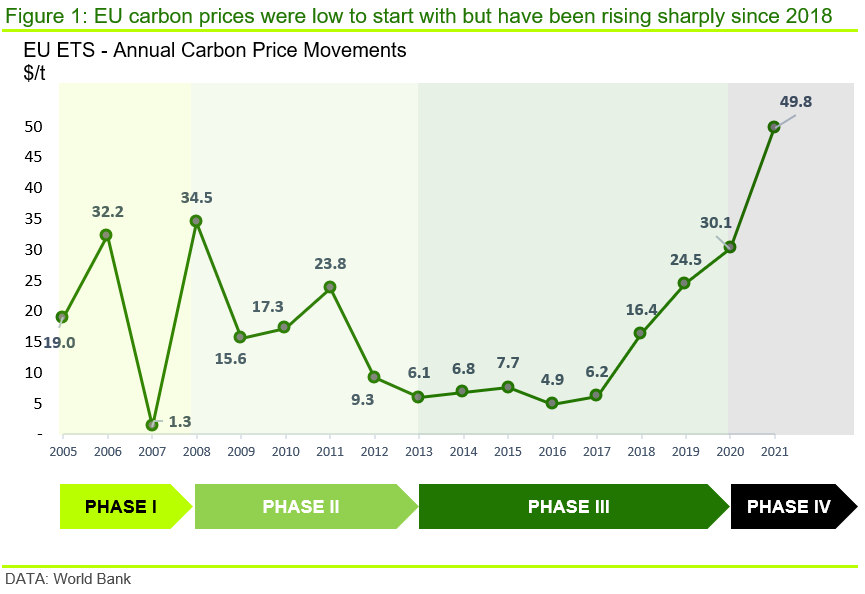

Exploring volatility of carbon price in European Union due to COVID-19 pandemic | Environmental Science and Pollution Research