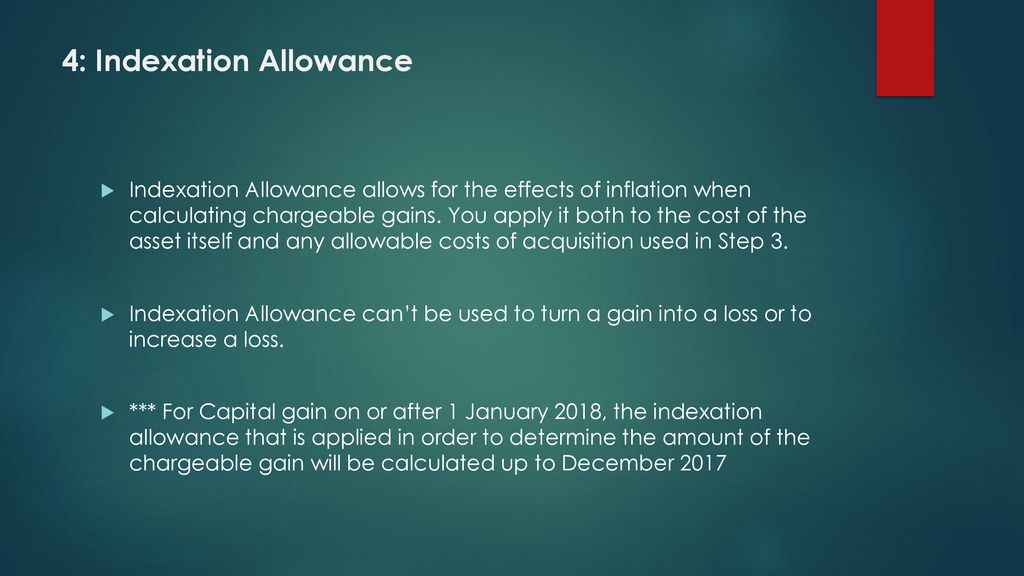

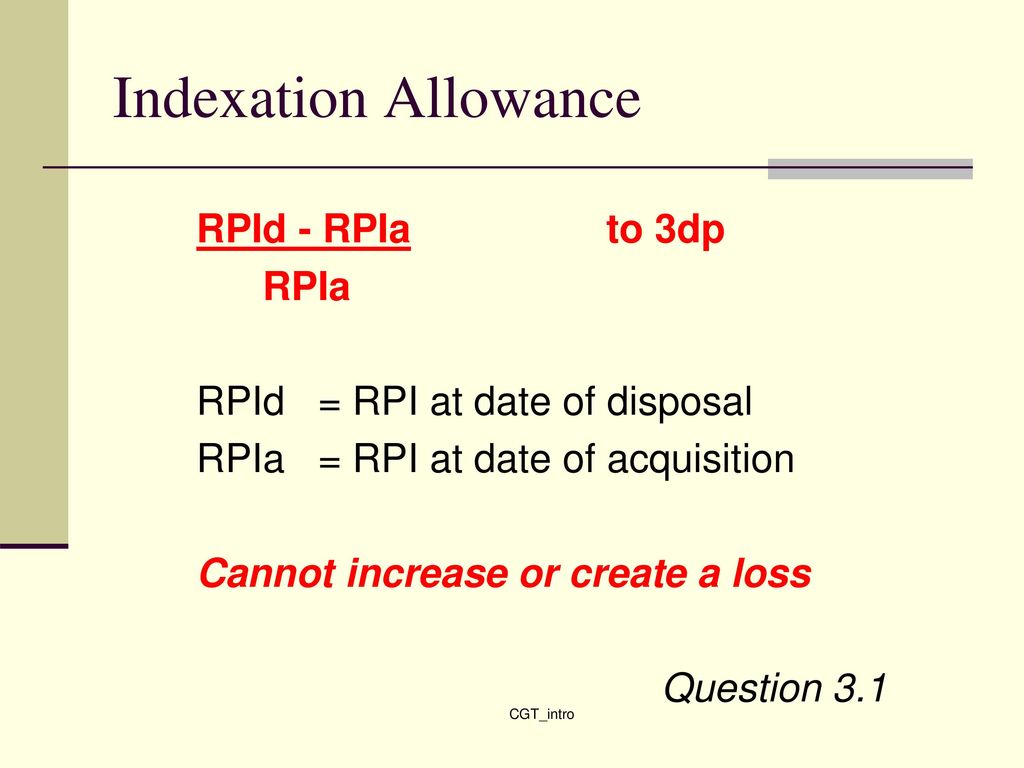

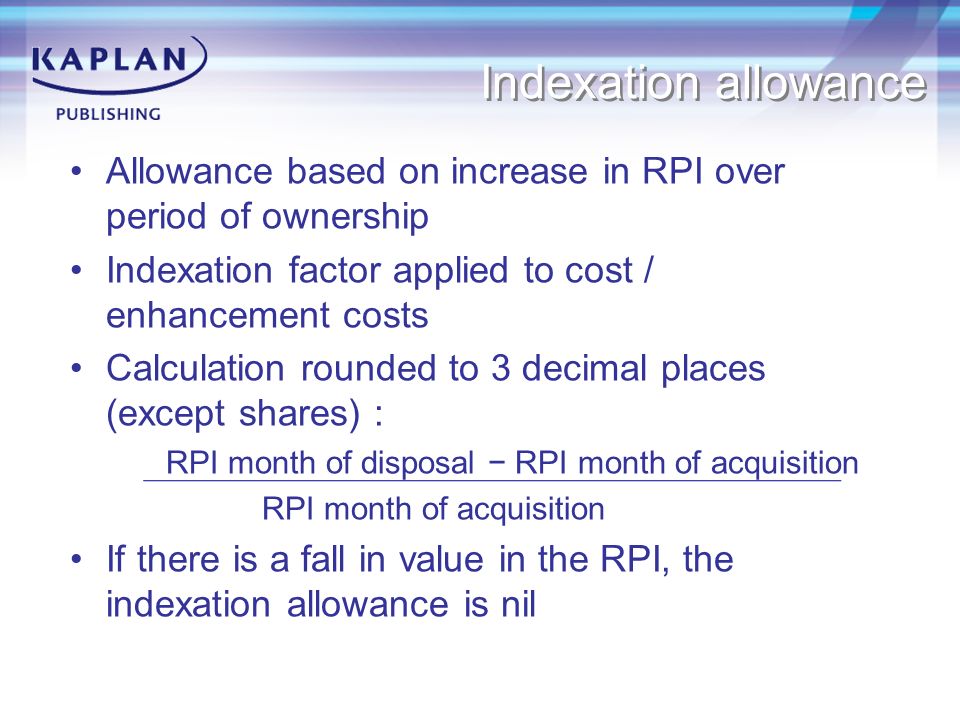

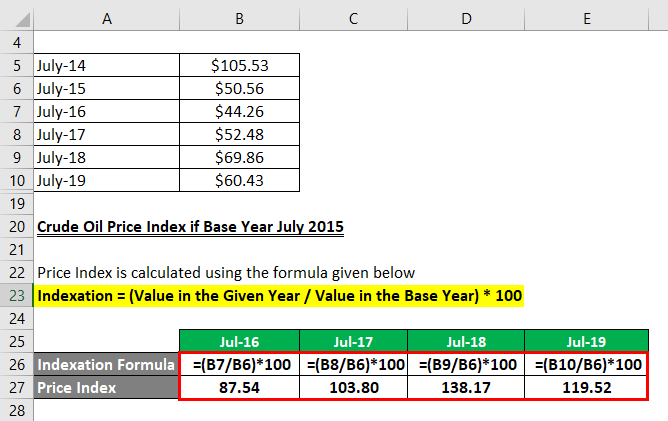

F6 Taxation (UK). Section A: The UK tax system Section B: Income tax liabilities Section C: Chargeable gains Section D: Corporation tax liabilities Section. - ppt download

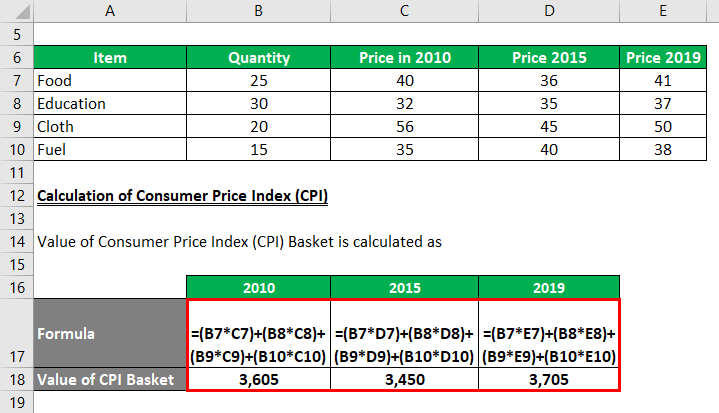

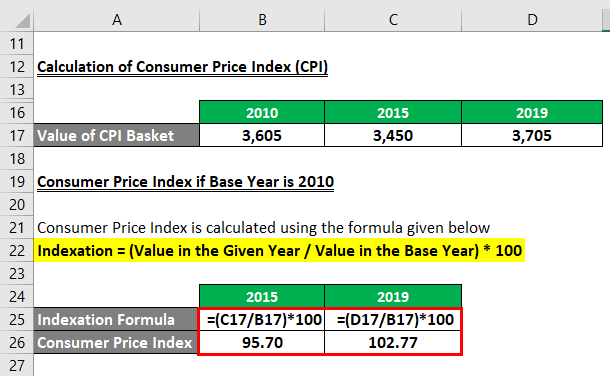

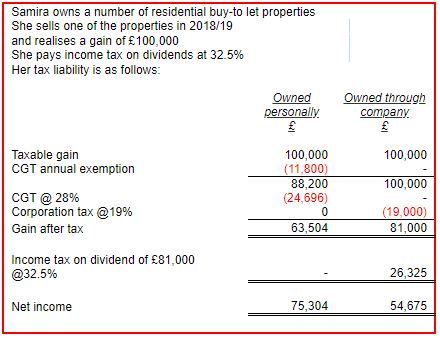

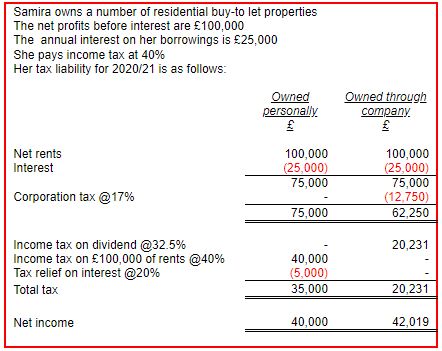

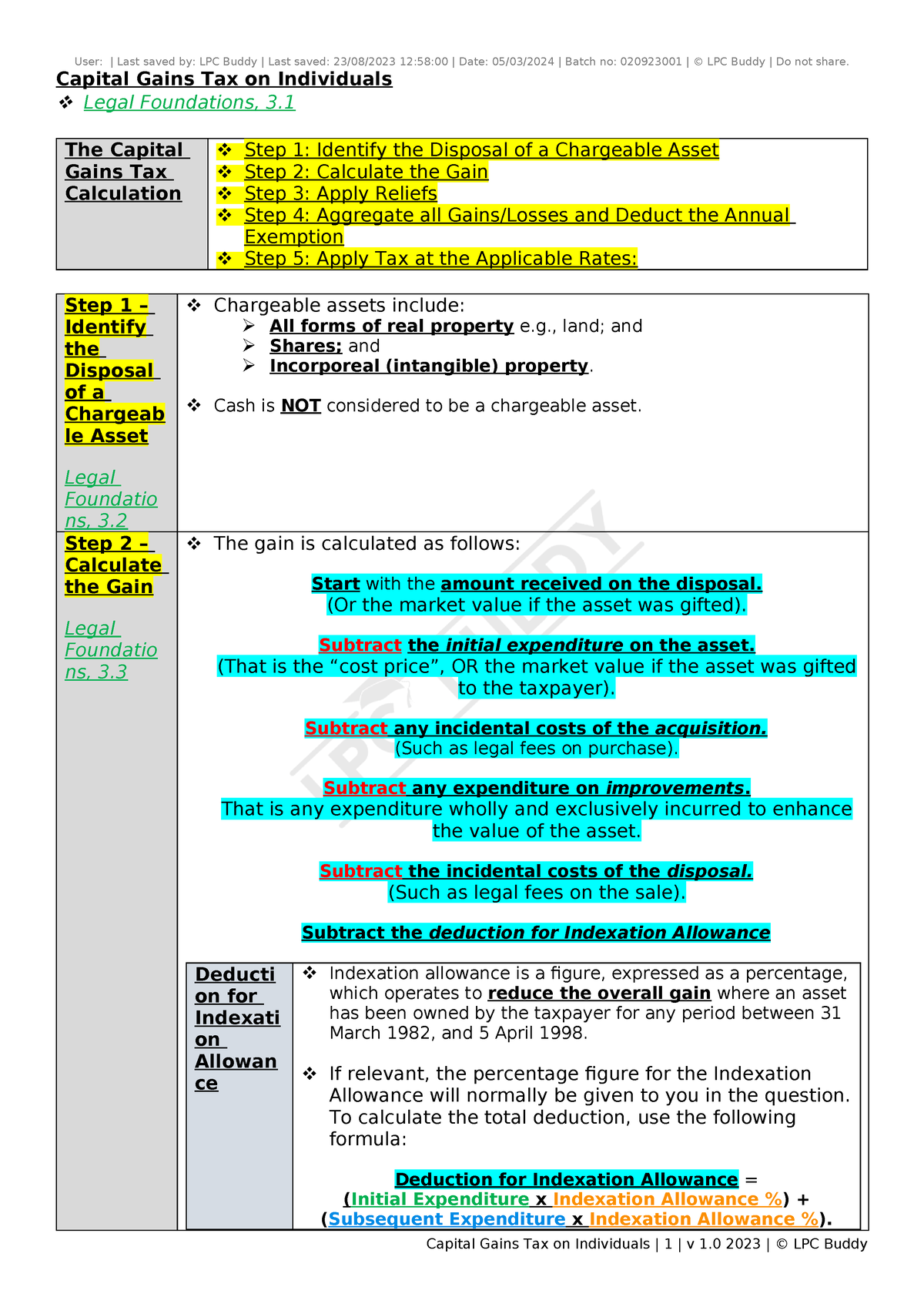

3. Capital Gains Tax on Individuals - The Capital Gains Tax Calculation Step 1: Identify the - Studocu

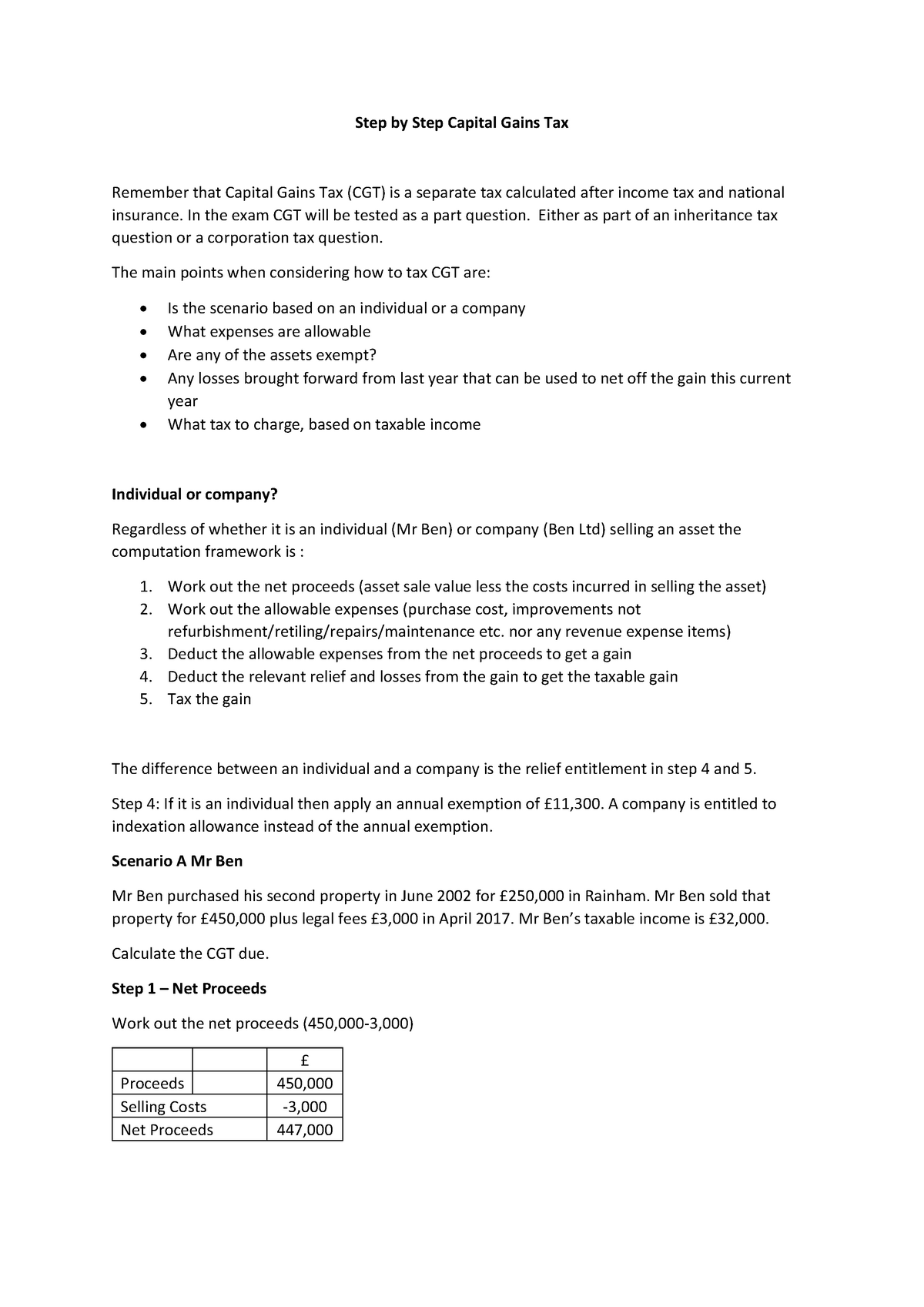

Capital Gains Tax Step by Step - Step by Step Capital Gains Tax Remember that Capital Gains Tax - Studocu

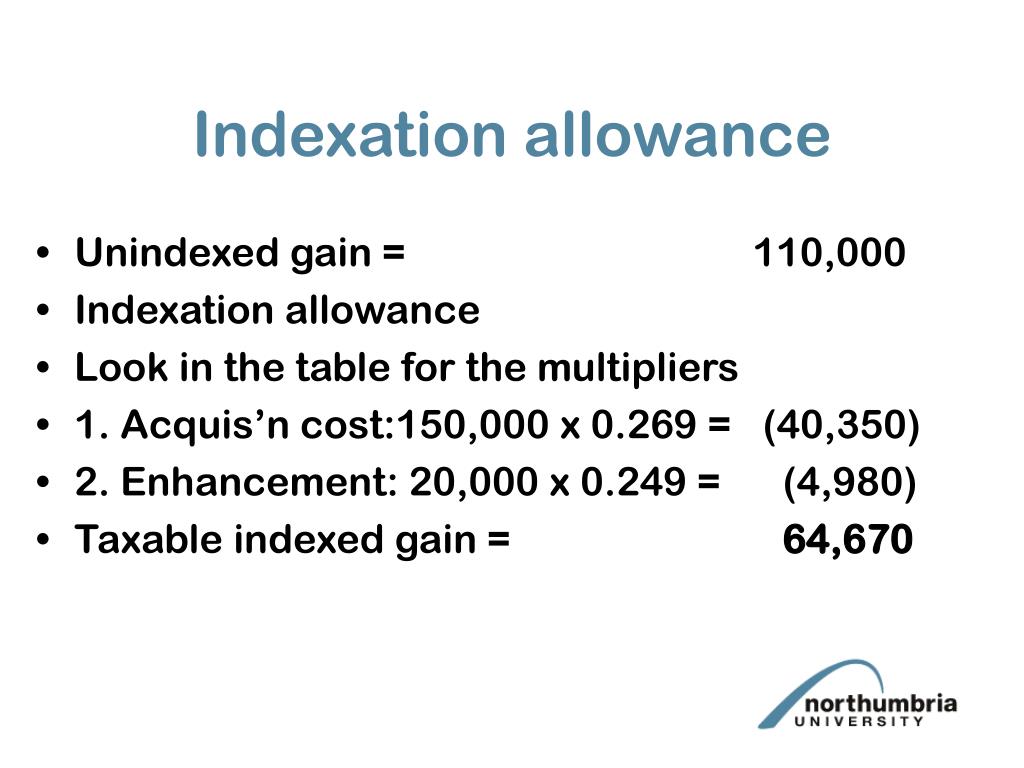

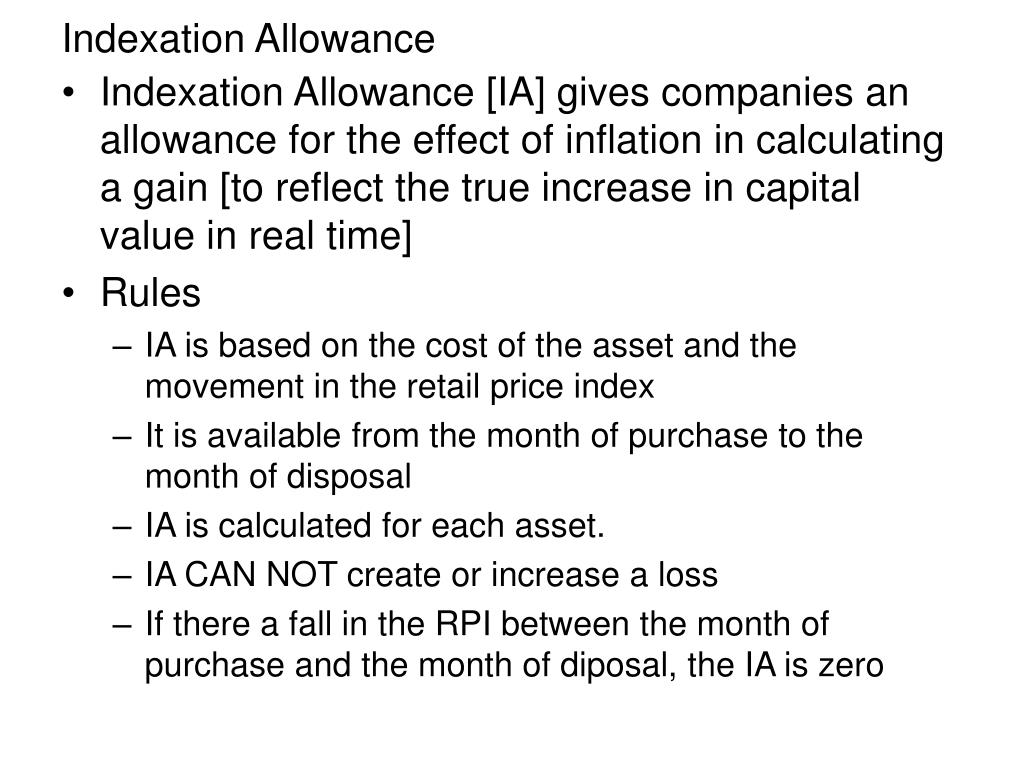

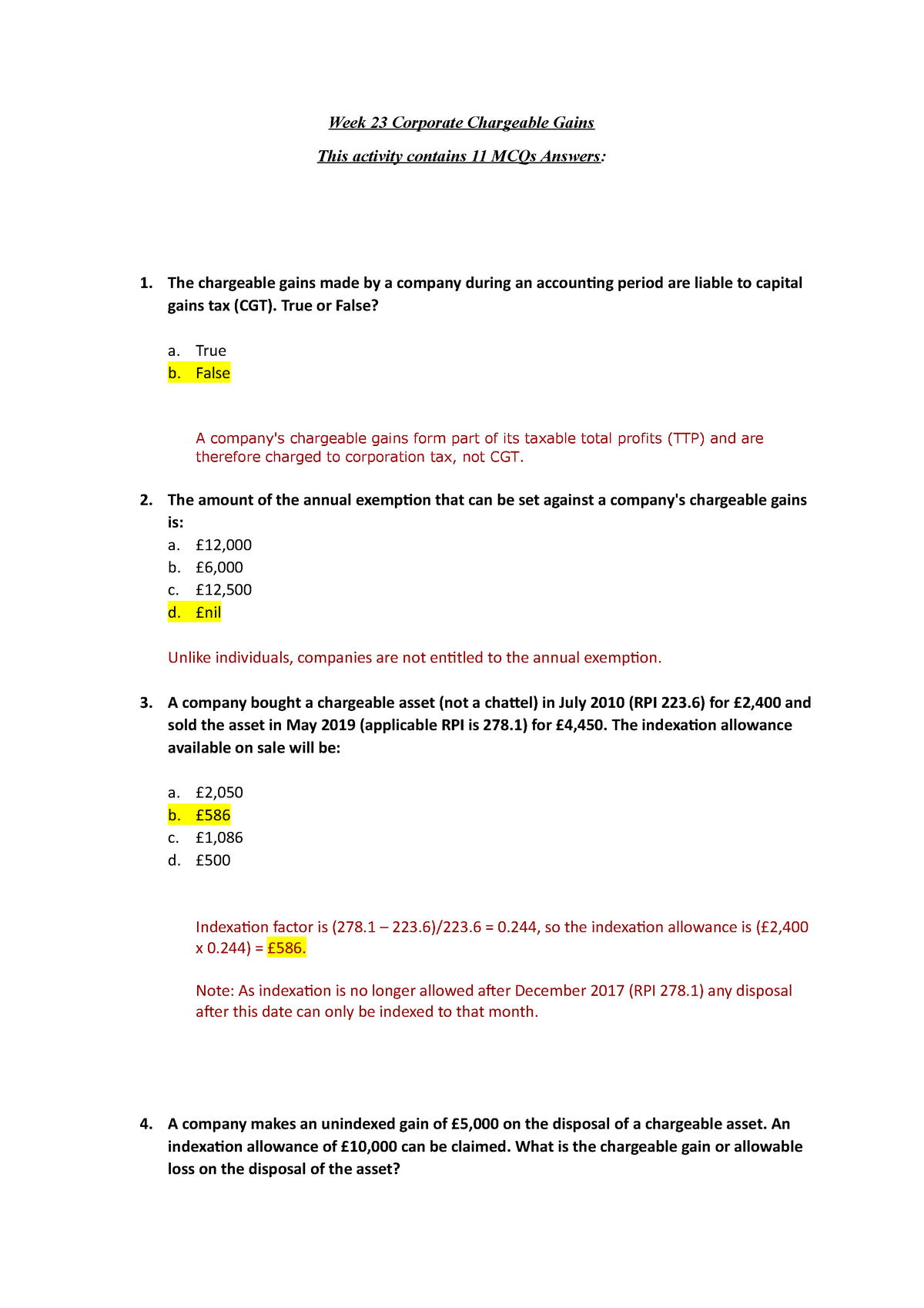

Week 23-Corporate Chargeable Gains-MCQ Answers - Week 23 Corporate Chargeable Gains This activity - Studocu

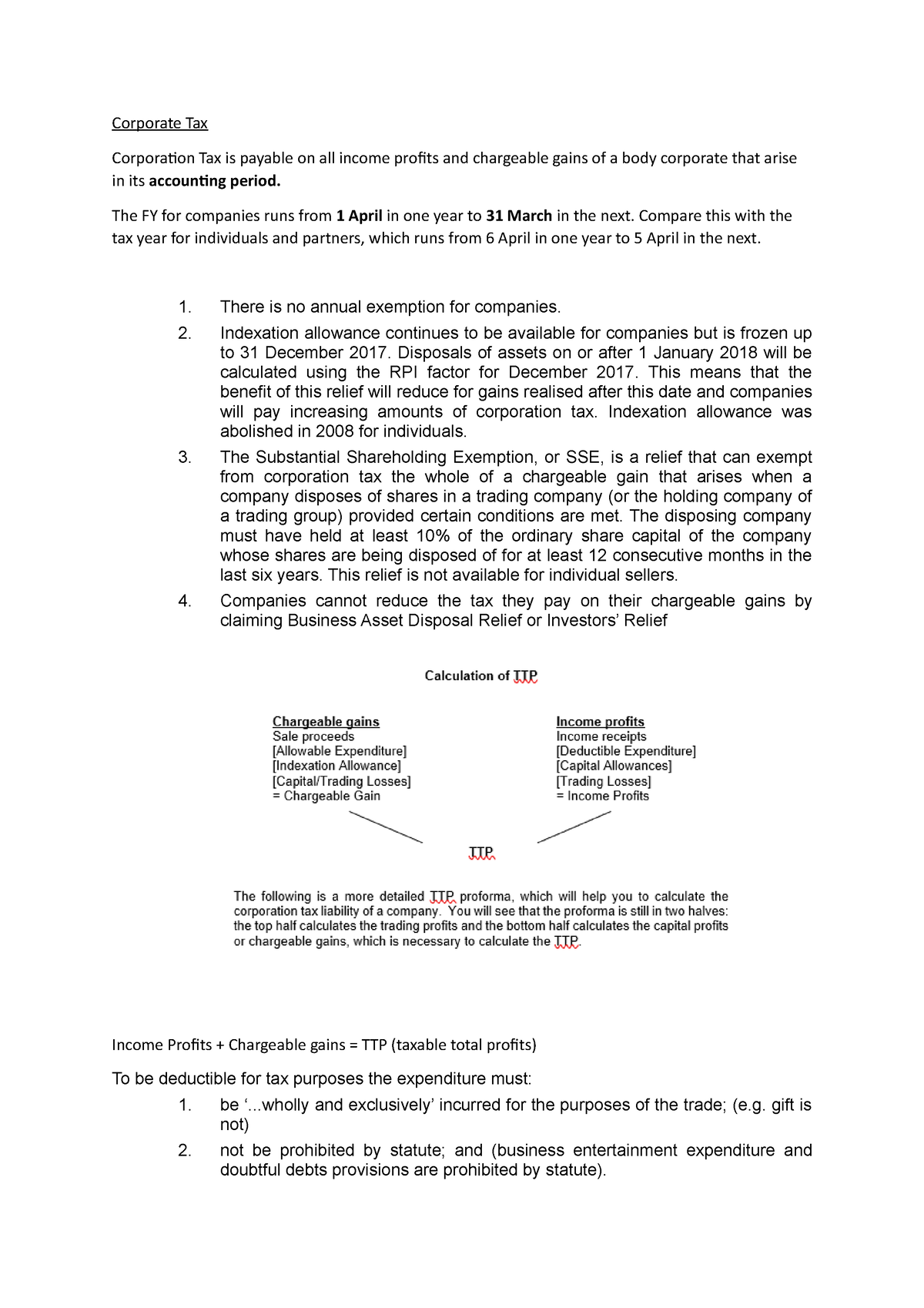

Corporate Tax R - Corporate Tax Corporation Tax is payable on all income profits and chargeable - Studocu

Press release: Keep indexation allowance freeze under review | The Association of Taxation Technicians