The Wonders of IRC Section 704(c) - A CPA's Guide to Selected Partnership/LLC Formation Issues and How to Deal with Them - American Institute of CPAs

US IRS concludes anti-abuse rule under Section 704(c) triggered in asset contribution to foreign partnership

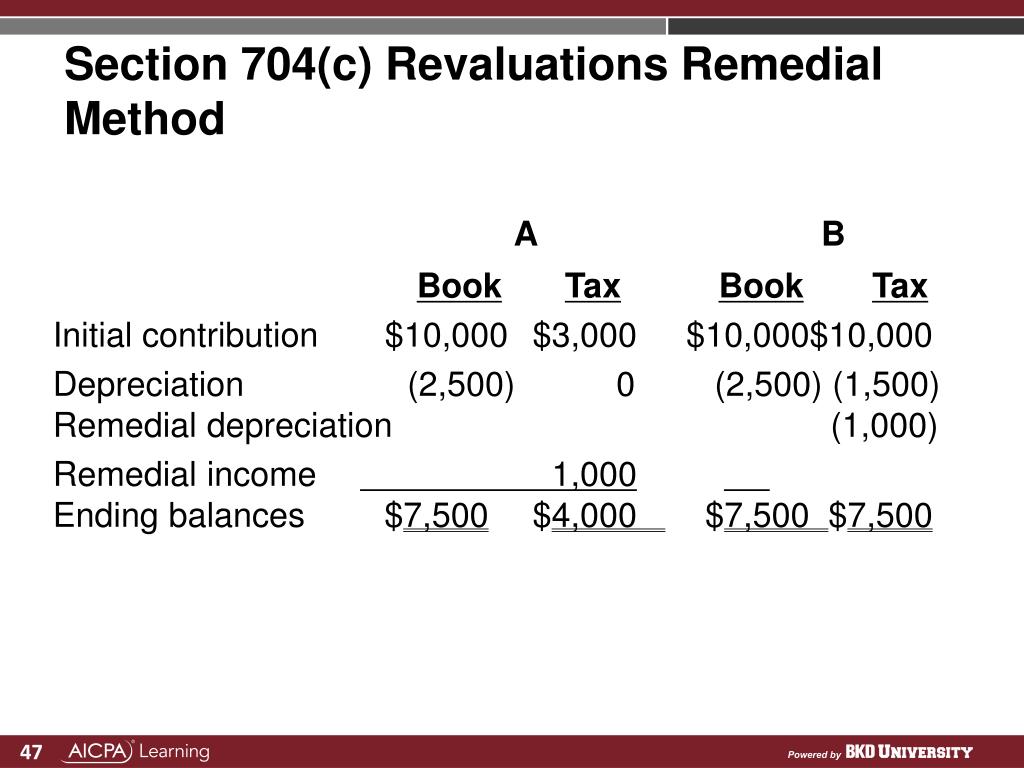

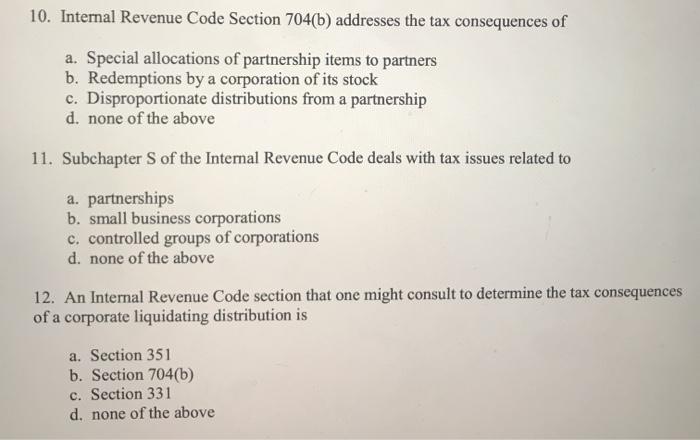

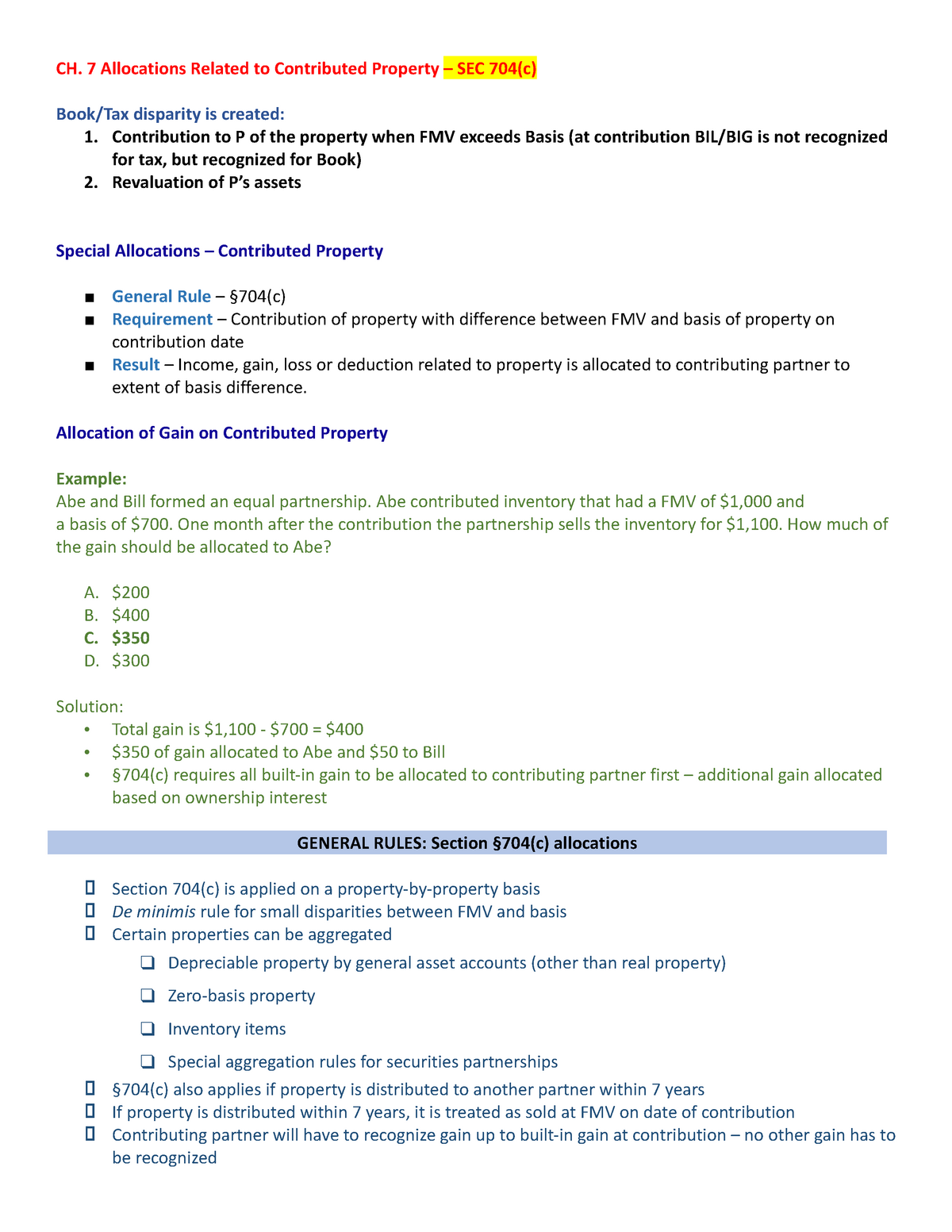

CH 7 notes - CH. 7 Allocations Related to Contributed Property – SEC 704(c) Book/Tax disparity is - Studocu

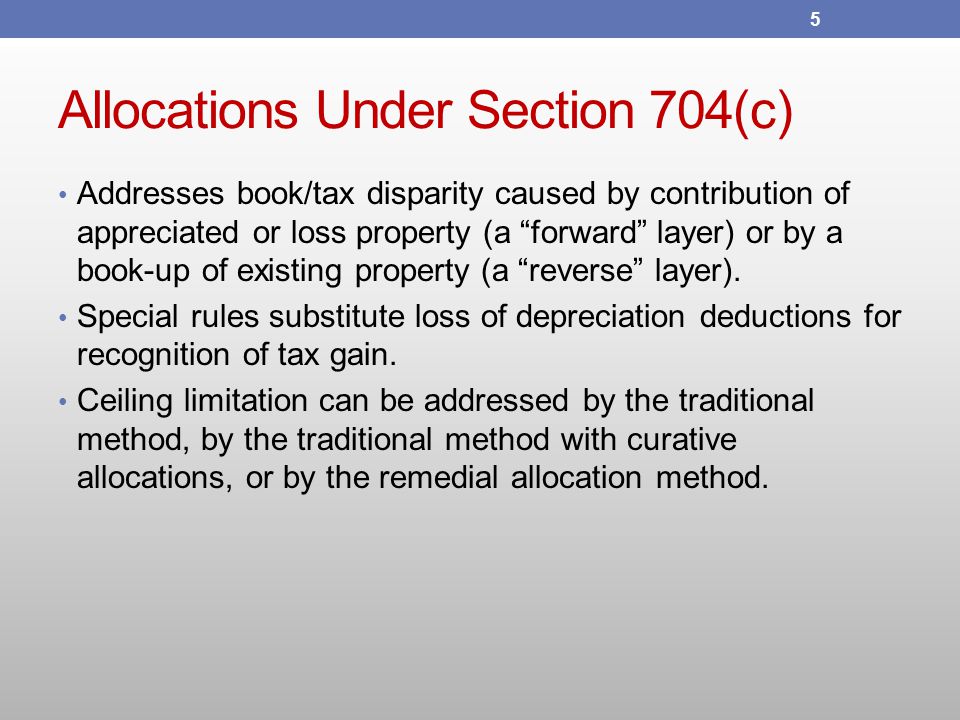

Allocations with Respect to Contributed Property (revised) Howard E. Abrams Warren Distinguished Professor, USD School of Law May ppt download

Disguised Sales and Other Mixing Bowl Provisions Howard E. Abrams Warren Distinguished Professor, USD School of Law November Copyright. - ppt download